The Canadian Construction Association (CCA) supports the principle that owners, prime contractors, subcontractors, suppliers, payment certifiers and other stakeholders in the payment chain comply with all statutory/legal requirements and honour commitments and contractual obligations.

In October 2015, CCA began participating on a government-industry working group to educate the federal government on the importance of prompt payment and cash flow on federal construction projects, and work together to resolve any concerns, which may include the enactment of federal prompt payment legislation acceptable to the industry.

Following the Singleton Reynolds Report in June 2018, which addressed concerns and recommendations raised by the Canadian Construction Association (CCA), prompt payment legislation was announced as part of the federal government’s fall economic statement on November 21, 2018 and officially introduced on April 8, 2019 as the Federal Prompt Payment for Construction Work Act, a sub-section of Bill C-97, the Budget Implementation Act of 2019.

The act applies to any federal real property or federal immovable. The Federal Prompt Payment for Construction Work Act received royal assent on June 21, 2019. The date of its official enactment remains undetermined, but, according to many pieces of legislation, is designated to come into force “on a day to be fixed by order of the governor-in-council”.

It is important to note that the legislation, once it comes into force, will not apply for one year in two categories:

(a) a contract entered into by a contractor, before the day on which this act comes into

force, with Her Majesty or a service provider; and

(b) a contract entered into by a subcontractor, before the day on which this act comes into force or within one year after that day, with a contractor referred to in paragraph (a) or with any other subcontractor.

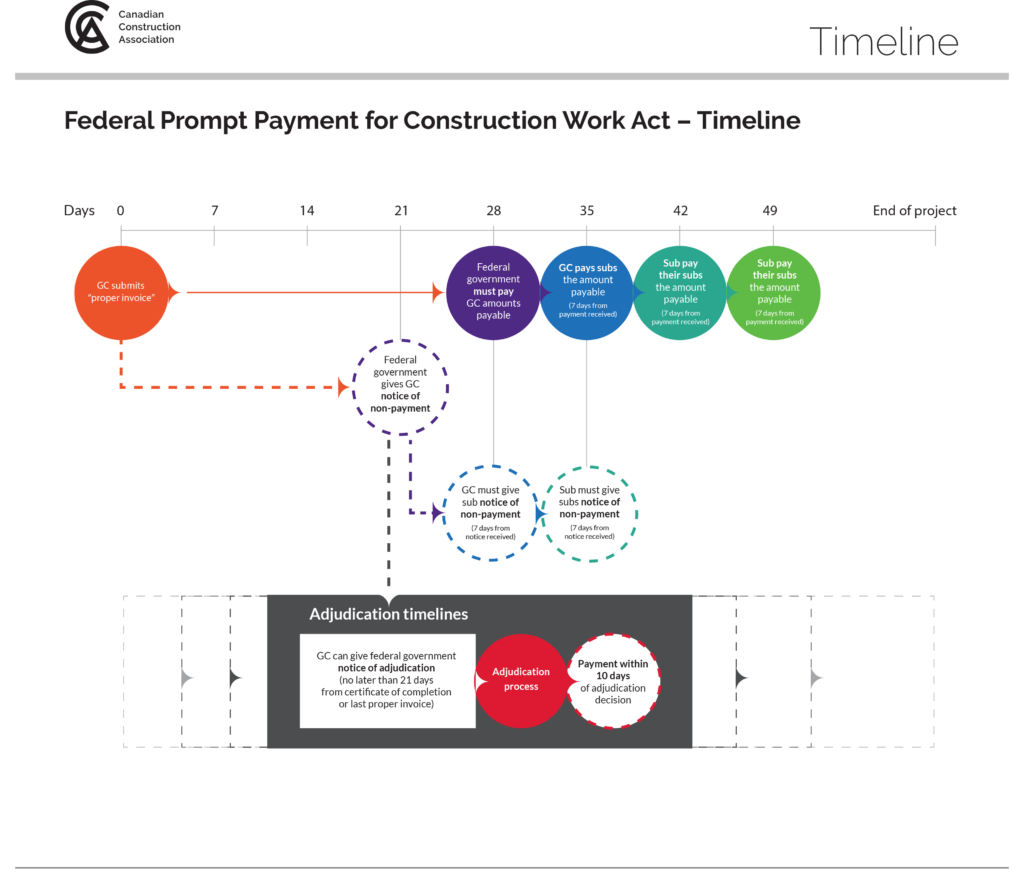

Federal Prompt Payment for Construction Work Act – Timeline